In this beginner’s guide, I will walk you through the basics of a financial model for a SaaS company. You´ll get lots of infos, so you can create a model that is accurate and informative. Building a financial model is an important first step in assessing whether or not your business is viable and you will need this document to raise capital and convince partners. So, let´s get right into it.

- Who is This Article For?

- What is a SaaS Business?

- Common Risks of SaaS Startups

- Micro SaaS vs Enterprise SaaS

- The Micro-SaaS Opportunity

- What is a SaaS Financial Model?

- Why Do You Need A Financial Plan?

- The Benefits of a Financial Model for a SaaS Startup

- The Different Types of Financial Models

- Key Components of a SaaS Financial Model

- Key Metrics of a SaaS Financial Model

- Google Sheets vs Microsoft Excel – Pros and Cons

- DIY vs Template?

- Conclusion

- My tailor-made Template for a SaaS Financial Model

Who is This Article For?

If you’re considering starting a software as a service company, or are just getting started, there are a few things you need to know. In this beginner’s guide, we’ll outline everything you need to build a basic financial model for your business. I’ll also suggest some resources and tools that can help you get started. So whether you’re just getting started or want to improve your existing model, read on!

What is a SaaS Business?

A SaaS business is a company that delivers software over the internet. This type of business is also known as cloud computing. The subscription-based service allows users to access and use the software from any device with an internet connection. This means your business can provide software to customers from their desktops, laptops, tablets, or mobile phones. In the SaaS model, a company charges a monthly fee for each user.

Common Risks of SaaS Startups

SaaS startups are becoming increasingly popular, but they also come with a number of risks. Here are some of the most common risks associated with SaaS startups:

1. Lack of experience: Many SaaS startups are founded by people who have little or no experience running a business. This can lead to a number of problems, including making poor decisions and not having the necessary skills to grow the company.

2. Unclear business model: A lot of SaaS startups struggle to create a clear business model that makes money. This can lead to long-term financial problems and even bankruptcy.

3. Lack of funding: It can be difficult for SaaS startups to get the funding they need to grow their business. This can limit their ability to scale and make it difficult to compete with larger companies.

Micro SaaS vs Enterprise SaaS

When it comes to software as a service (SaaS), there are two main types: Micro SaaS and Enterprise SaaS. Micro SaaS is generally a small business run by a small team, while enterprise saas is a larger organization. Another difference is price. Micro saas is typically less expensive than enterprise saas, since it requires less infrastructure and support.

The Micro-SaaS Opportunity

Micro SaaS businesses are often started by entrepreneurs who want to provide a simple solution to a specific problem. Micro SaaS businesses can be profitable, but they require a lot of work to get off the ground.

One of the benefits of starting a micro SaaS business is that you don’t need a lot of money to get started. In fact, you can often start by using online tools like Notion, Airtable, WordPress, or bubble.io. However, you will need to invest in building a good product and marketing it to your target market.

Another key factor in the success of micro SaaS businesses is finding the right pricing model. You want to make sure you’re charging enough to cover your costs while still providing value to your customers.

What is a SaaS Financial Model?

SaaS, or software as a service, is a type of subscription software that allows users to access and use the software from a remote location. The SaaS financial model is a way for companies to track and analyze the financial performance of their SaaS operations. The model includes revenue and expense projections, as well as cash flow statements. It can be used to help make decisions about whether or not to launch a SaaS product and to evaluate the financial feasibility of potential SaaS offerings.

Why Do You Need A Financial Plan?

If you don’t have a financial plan, you’re probably not taking control of your financial future. A financial plan is more than just a budget; it’s a roadmap to help you achieve your financial goals. Without a plan, it’s easy to get sidetracked and make poor financial decisions. Here are seven reasons why you need a financial plan for your SaaS business:

- To get a deeper understanding of your business model

- To convince investors and business partners

- To raise capital

- To create and track progress towards your goals

- To provide a framework for making sound financial decisions

- To help identify and manage risk

- To help you understand what you need to do to achieve your goals.

The Benefits of a Financial Model for a SaaS Startup

A well-constructed financial model is an invaluable tool for any startup. It can help you evaluate the business potential of your idea, determine how much money you need to raise, and plan for future growth. A good financial model should include a detailed income statement and cash flow projection. This will give you a clear picture of how your business is performing financially and help you make informed decisions about where to allocate your resources. If you’re a SaaS startup, it’s especially important to build a financial model that takes into account the unique challenges and opportunities of the subscription-based business model. With a solid financial model in place, you’ll be able to make confident decisions about pricing, product development, and marketing.

The Different Types of Financial Models

There are many different types of financial models that can be used to help a startup company forecast, track and report its revenue and operating expenses. The most common type of model is the forecast model, which projects future sales and operating income. This type of model is used to make informed decisions about raising capital, hiring, expansion, and other strategic decisions. The forecast model can also be used to create reports for management and investors. Another common type of financial model is the break-even analysis, which determines the point at which a company’s revenue equals its costs. This information can be helpful in determining pricing strategies and assessing the financial feasibility of new products or services.

Key Components of a SaaS Financial Model

There are a few key components to a financial model that are essential for it to function accurately.

Assumptions

Assumptions are the underlying factors that the model is based on. They can be things like historical sales data, projected growth rates, or expected changes in the cost of goods. Without accurate assumptions, the rest of the model will not be reliable.

Formulas

Formulas are what connect the assumptions to the resulting financials. They dictate how each assumption impacts profits, expenses, and cash flow. If any of the formulas are incorrect or inaccurate, it can throw off the entire model.

Data Source

Further, it’s important to have a good data source. The data in a financial model should come from reliable and accurate sources. This ensures that the numbers in the model are correct and can be relied on for decision-making.

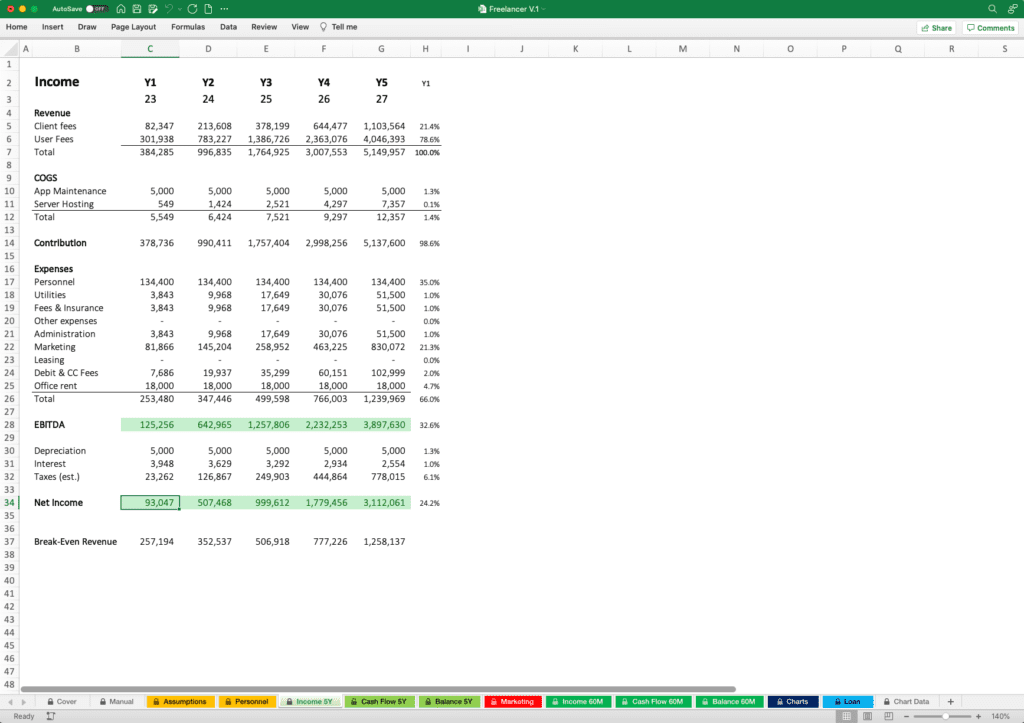

Income Statement

An income statement is a financial statement that shows how much money a company has earned and spent over a specific period of time. The income statement is also known as the profit and loss statement (P&L). The main sections of the income statement are revenue, gross profit, operating expenses, and net income.

Cash Flow Statement

A cash flow statement is a financial statement that shows how much cash a company has generated and used during a specific period of time. The cash flow statement is divided into three sections: operating, investing, and financing activities. The operating section shows the cash generated and used by the company’s core business operations. The investing section shows the cash generated and used by the company’s investments, such as purchasing property or stocks. The financing section shows the cash generated and used by the company’s sources of capital, such as issuing or repaying debt or issuing or buying shares of stock.

Balance Statement

A balance statement is a financial statement that shows the financial condition of a company at a specific point in time. The balance sheet lists the company’s assets, liabilities, and shareholders’ equity. The balance sheet is the starting point for doing business and calculating a company’s financial condition.

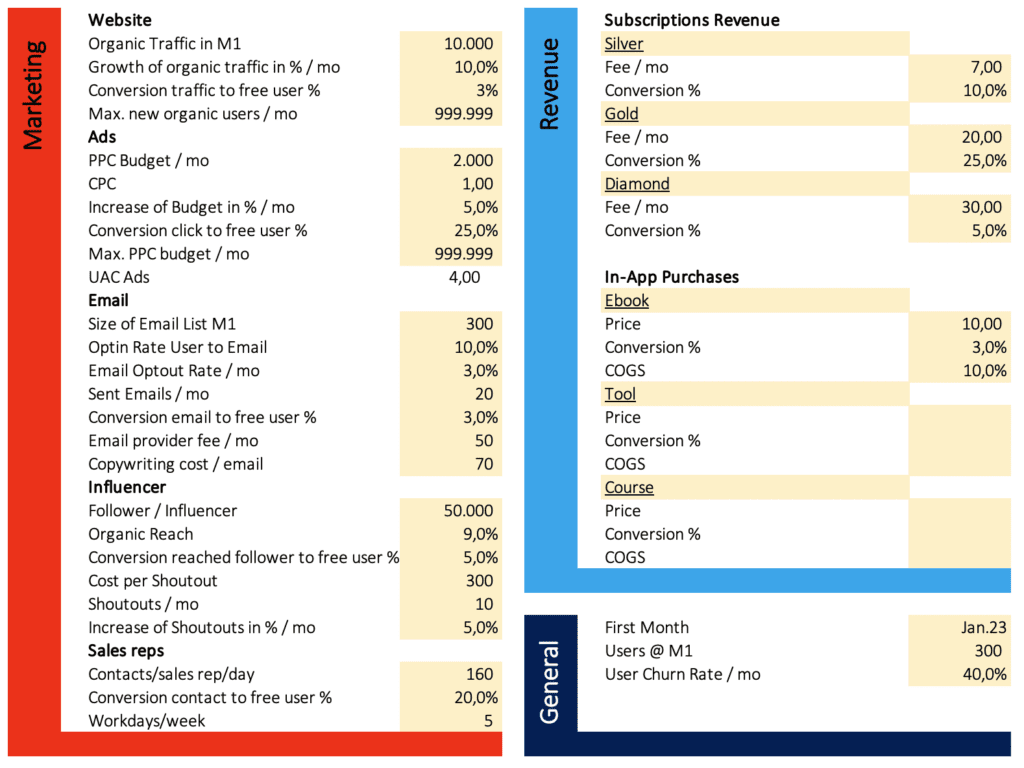

Marketing a SaaS Product

Marketing is the process of creating value for a company through the creation and distribution of products or services. It is a strategic process that involves creating a plan to reach target consumers and generate demand for a product or service. Sales reps can be a great resource for promoting your Saas product. They have a personal relationship with their clients and can provide valuable insights about how to use your product. Additionally, many influencers are active on social media, so they can help promote your product online. You can also reach out to them to promote your product. Influencers have a large following online and can help get the word out about your software product. Additionally, you can run online ads and publish helpful and relevant articles on your website, and include information about your SaaS product.

Business Modell of a SaaS Startup

The most common sources of income for a Saas business are monthly subscriptions, in-app purchases, and advertising income. Monthly subscriptions are the main source of revenue for most Saas businesses. In order to encourage customers to subscribe, businesses need to provide a valuable service that is worth the monthly cost. In-app purchases are another common source of revenue for Saas businesses. These purchases can be for additional features or services, or they can be used to upgrade to a premium version of the software. Advertising income is also a common source of revenue for Saas businesses. Ads can be displayed on the website or within the software itself.

Major Expenses of a SaaS Business

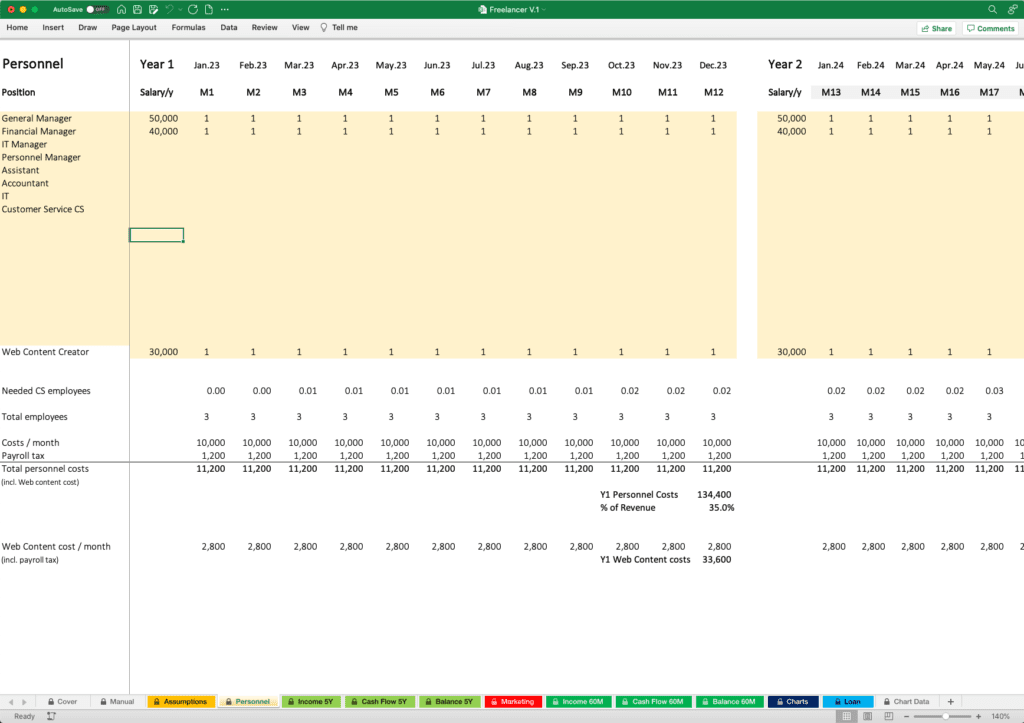

Running a software as a service (SaaS) business is not cheap. Though the cost of starting and running a SaaS business has come down in recent years, there are still many expenses businesses need to account for. One of the biggest expenses for any SaaS business is employee salaries. Employees working in customer service, development, and marketing require compensation that reflects their skills and experience. Additionally, businesses need to account for the cost of benefits such as healthcare and retirement plans. Another big expense for SaaS businesses is technology infrastructure. This includes costs such as servers, software licenses, data storage, and bandwidth. Businesses also need to budget for upgrading their technology infrastructure as their company grows.

Hiring plan of a SaaS Startup

In order to ensure a successful launch and long-term growth of your SaaS startup, it is important to put together a hiring plan early on. Here are the key steps to follow:

- Define your needs. What specific skills and experience do you need in your early team? Be realistic in your assessment; it may be more difficult (and expensive) to find top talent in today’s market.

- Scout for talent. Use all available resources to identify potential candidates, including job boards, social media, and networking events.

- Screen candidates carefully. Take the time to review resumes and conduct phone interviews before bringing candidates in for face-to-face interviews.

- Make an offer they can’t refuse. Once you’ve found the right candidate, make sure you present a competitive offer that meets their needs and expectations.

Financing a SaaS Startup

Financing a SaaS startup can be a difficult task. You need to find the right investors who understand your business and can help you grow. There are a few different ways to finance your SaaS startup, and each has its own benefits and drawbacks.

Venture Capital

One way to finance a SaaS startup is through venture capitalists. Venture capitalists are investors who put money into young companies in the hope that they will become successful and profitable. They usually invest large sums of money, and they expect a large return on their investment if the company is successful.

Angel Investor

Another way to finance a SaaS startup is through angel investors. Angel investors are individuals or groups of individuals who invest in young companies in exchange for a share of the company’s stock. They usually invest smaller sums of money than venture capitalists, but they also expect a smaller return on their investment. SaaS startups often use venture capital to finance their growth. To convince an investor, the founder must satisfy the venture capitalists’ expectations for a return on their investment.

Debt

A third option to finance a SaaS startup is through debt financing. SaaS startups have access to a variety of debt financing options. For example, they can take out a loan from a bank or other lending institution. They also may be able to draw on their credit cards, lines of credit, and/or other personal financial resources.

Crowdfunding

Finally, a SaaS business can get funding through crowdfunding, a popular way to raise money for a project. Crowdfunding websites like Kickstarter and Indiegogo allow people to raise money for their projects in exchange for equity or rewards.

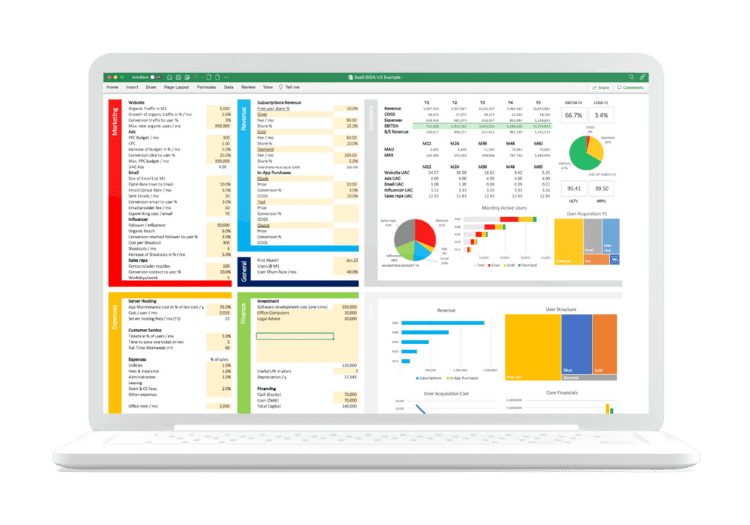

Charts

There are a variety of charts that are helpful for understanding the core financials and user structure of a saas startup. The first chart to look at is typically the revenue chart. This will show you how much revenue the startup is generating on a monthly or annual basis. It’s also important to look at the user growth chart, as this will give you an idea of how quickly the user base is growing. A user acquisition chart shows you, the number of customers each marketing campaign generates. Finally, it’s helpful to look at the user structure chart to see which subscriptions models are most popular.

Key Metrics of a SaaS Financial Model

A strong SaaS financial model is essential for a healthy business. Key metrics to track are monthly recurring revenue (MRR), average revenue per user (ARPU), customer acquisition costs (CAC), lifetime value (LTV), churn, and liquidity.

- MRR is the most important metric as it indicates the health of the business and growth potential. It can be calculated by multiplying the number of customers by their average monthly subscription fee.

- ARPU measures how much revenue a company generates from each customer on average. It can be calculated by dividing total subscription revenue by the number of subscribers in a given period.

- CAC represents how much money a company spends to acquire a new customer on average. It is important to keep this figure as low as possible in order to maintain a healthy profit margin.

- LTV is a measure of the amount of money a company will have to pay in order to acquire a customer. It can be calculated by dividing total subscription revenue by the amount of credit card debt for these customers.

- Churn rate is a measure of how many customers will cancel their subscriptions. It can be calculated by dividing total subscription revenue by the number of subscribers in a given period.

- Liquidity is a measure of how liquid a company’s assets are. Any business needs a source of cash to keep it operating. In order to do so, it needs to generate a profit or raise additional capital. A company’s liquidity is measured by the amount of cash and marketable securities it has available. It can be calculated by comparing total assets with total liabilities.

Google Sheets vs Microsoft Excel – Pros and Cons

Google Sheets and Microsoft Excel are both spreadsheet applications that allow users to create and edit tables of data and are a great base to build a financial model. They both have a variety of features in common, but there are also some key differences. Let´s have a brief look at these two applications.

Google Sheets and Microsoft Excel are both software programs used for creating and editing spreadsheets. They are both very popular programs, but there are some differences between them. Microsoft Excel is a more traditional spreadsheet program. It is more complex than Google Sheets, and has more features. However, it can be more difficult to learn how to use Excel. Google Sheets is a newer program, and is simpler than Excel. It has fewer features, but is easier to learn how to use. Google Sheets is also free, while Excel costs money. Both applications allow users to create and edit tables of data, organize data into cells and rows/columns, perform calculations, and create graphs from data. They also both have a wide range of built-in functions that can be used to manipulate data. It’s also worth noting that Google Sheets is a web-based application while Microsoft Excel is available on most desktop operating systems.

Regarding a financial model, I prefer to use Excel, because it allows the protection of certain cells. This prevents formula mistakes and increases reliability and usability. Further, Excel provides wonderful charts, that Google doesn´t have.

DIY vs Template?

When creating a financial model, you have two options: do it yourself or use a template. There are pros and cons to both methods. Doing it yourself allows for more customized and detailed models, but can be time-consuming and require strong math skills. And if you don´t have experience with this task, there is a higher risk of building false formulas and getting wrong results. Using an industry-specific template is much faster and easier, and some products also come with built-in tutorials to help you get started. And when the template is based on Excel or Google Sheets, you can further adapt it to your needs or ask the author to do this for you.

Conclusion

In conclusion, building a financial model for a SaaS company is a complex but essential process. By following the steps outlined in this guide, you’ll be able to create a model that will help you make informed decisions about your business. Remember to always use realistic assumptions and to update your model as your company grows. And most importantly, don t be afraid to ask for help when you need it. With these tips in mind, you’re ready to start building your own SaaS financial model.

My tailor-made Template for a SaaS Financial Model

You don´t have to reinvent the wheel, check out my Financial Model for a SaaS Business! It´s based on Microsoft Excel, easy to use, and priceless when it comes to making better decisions faster.

Peter is a solopreneur in Salzburg, Austria, a husband, and a family father. He runs a little publishing company, and blogs about starting and running online businesses. In his spare time, he enjoys hiking with friends and reading the Bible, and sometimes he takes a trip in his roaring old black 2001 Jaguar XJ8.