70% of startups fail at the end of the 10th year [1], and 29% run out of cash [2].

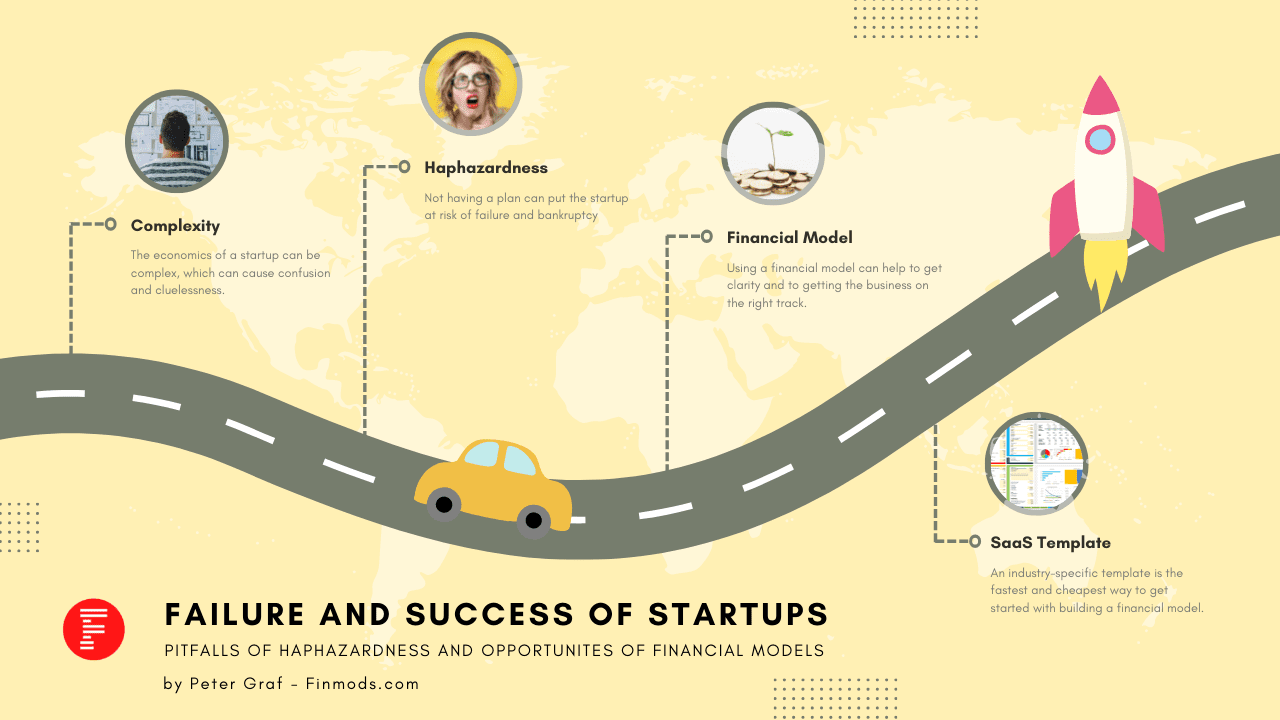

Many startups have a great business idea but don’t know how to make it economically viable. Complexity often leads to haphazardness, one of the main reasons startups fail.

In part one, we take a deeper look into the anatomy of startup failure to clearly understand the underlying problem.

In part two, we discover the benefits of a financial model to avoid common pitfalls. For example, I will show you a financial model for a SaaS startup.

- Part One: The Road to Failure

- Complexity, confusion, cluelessness

- 14 dangers of haphazard management

- 1) Lack of structure

- 2) Unclear goals

- 3) Chasing the wrong goals

- 4) Not knowing the market

- 5) Not knowing your customers

- 6) Not understanding your finances

- 7) Financial instability

- 8) Lack of customer loyalty

- 9) Employee turnover

- 10) Not having the right team

- 11) Poor reputation

- 12) Business goals may not be met

- 13) Financial trouble

- 14) Missing out on opportunities

- The risk of bankruptcy

- Part Two: Succeeding with a Financial Model

- Conclusion

Part One: The Road to Failure

Complexity, confusion, cluelessness

The economics of a startup can be difficult to understand for various reasons. First, startups are characterized by a high degree of uncertainty. This means that many unknown factors can affect the success or failure of a startup, which makes it difficult to predict how the business will perform. Complexity confuses many founders. Additionally, startups typically have limited resources, making it challenging to generate enough revenue to sustain the business.

These challenges tempt many founders to skip essential planning steps and rely on their gut feeling, which often means cluelessness. Let´s learn more about the consequences.

14 dangers of haphazard management

Haphazardness can cause serious problems:

1) Lack of structure

The dangers of lack of structure for startups are numerous. Without a clear organizational structure, it can be difficult to assign tasks and responsibilities, which can lead to confusion and inefficiency. Additionally, without a well-defined structure, it may be difficult to secure funding or attract investors. Startups that lack structure often flounder and fail to meet their potential.

2) Unclear goals

When starting a business, it is important to have a clear understanding of what your goals are. Without a clear goal, it can be difficult to make decisions that are in the best interest of the company. This can lead to problems, such as financial difficulties or legal issues. It is therefore important to take the time to sit down and clearly define what your goals are before moving forward with any business venture.

3) Chasing the wrong goals

First and foremost, it can lead to chasing goals not aligned with the core values or mission of the startup. This can cause the founders to lose sight of what they are trying to achieve and ultimately fail. Additionally, it can also lead to a startup pursuing goals that are not realistic, and this can lead to frustration and disillusionment among the team members.

4) Not knowing the market

If you don’t know the market, you may be unable to find the right investors for your company. This can lead to a lack of funding and, ultimately, the failure of your startup. Further, not knowing the market can also lead to poor strategic decision-making. For example, you may make poor decisions about which products to develop or how to position your company in the market.

5) Not knowing your customers

When starting a business, you must understand who your customers are. Without this knowledge, you could be putting your business at risk. Here are some of the dangers of not knowing your customers:

1. You could end up targeting the wrong market.

2. You could produce products or services that no one wants or needs.

3. You could waste time and money marketing to people who will never become your customers.

6) Not understanding your finances

The dangers of not understanding finances are numerous and can lead to the company’s downfall. Without a clear understanding of where the money is coming from and where it is going, it is difficult to make sound financial decisions that keep the company afloat. This can lead to financial problems down the road, such as not being able to pay employees or suppliers, which can ultimately lead to the demise of the startup.

7) Financial instability

If a startup does not have enough cash, it may have to use debt to finance its operations. This can put the startup in a very precarious position if the business does not perform as well as expected. Additionally, if a startup does not have enough cash flow to cover its expenses, it may be forced to close its doors, which happens to 29% of startups [2].

8) Lack of customer loyalty

Without customer loyalty, it can be difficult to establish a customer base, generate repeat business and grow the startup. And a lack of customer loyalty can lead to negative word-of-mouth, further damaging the startup’s reputation and bottom line.

9) Employee turnover

Startups often rely on a few key employees to get the business off the ground. Losing one of these key employees can set the startup back months or even years. And startups often have limited resources, so they can ill afford to lose any employees, let alone experienced ones.

10) Not having the right team

A bad team causes several risks. First, the company may not be able to execute its business plan. This can lead to financial problems and ultimately the failure of the company. Second, without the right team, the company may miss important opportunities. Third, the company may make bad decisions that can jeopardize its future.

11) Poor reputation

There are some dangers associated with a poor reputation. First, it can adversely affect the ability of the startup to raise capital. Second, it can damage the startup’s relationships with key partners and customers. Third, it can lead to negative publicity. Finally, a poor reputation can lead to decreased employee morale and turnover.

12) Business goals may not be met

If a startup does not meet its business goals, it may have to shut down. This would result in the loss of jobs and possibly the loss of investment money. The failure of a startup can also lead to the failure of other businesses associated with it.

13) Financial trouble

While some entrepreneurs can find the necessary funding to get their business off the ground, others are not so lucky. This can often lead to them having to take out loans or use credit cards to finance their venture, which can put them at a severe disadvantage.

14) Missing out on opportunities

First and foremost, missing out on opportunities can lead to a decrease in potential revenue. Furthermore, it can lead to a loss of market share and a failure to gain a competitive edge. Additionally, missing out on opportunities can also result in a decreased ability to attract and retain top talent. Finally, missing out on opportunities can negatively impact morale and cause employees to disengage.

The risk of bankruptcy

Remember that 70% of startups fail at the end of the 10th year [1], and 29% run out of cash [2].

If a business stays too long on the road to failure, it will be broken someday, which is hard to overcome. The first thing usually happens is that the founders and employees lose their jobs. This can devastate them, as they have put so much time and effort into the company. The next thing that happens is that the company’s assets are sold off to pay creditors. This includes office furniture, equipment, and any intellectual property. The company is dissolved and ceases to exist.

The bankruptcy of a startup can also be extremely detrimental to the founders´ financial stability. Among the most common negative effects are the following:

1. Bankruptcy can negatively impact the credit score for up to 10 years.

2. Bankruptcy can make it difficult to obtain new lines of credit or loans.

3. Bankruptcy can result in the loss of certain assets, such as a home or car.

In short, founders can lose everything when they go bankrupt and then have to start all over again.

So far, we have discussed the risks and negative impacts of haphazardness.

In the next part, you can discover how a financial model can help you to get your business on the right track.

Part Two: Succeeding with a Financial Model

Many strategies can be employed to make a startup successful.

One key strategy is to ensure that the startup has a strong and experienced management team in place.

Another strategy is to create a detailed business plan that outlines the goals and objectives of the startup, as well as how these will be achieved.

Additionally, it is critical to secure adequate funding from investors to support the startup’s growth.

Another option is to build partnerships with other companies in complementary industries.

In this article, we focus on building a financial model.

What is a financial model?

A financial model is a tool to predict the future financial outcomes of a business. The model is typically created in Excel and contains several inputs and outputs. The inputs include sales projections, cost of goods sold, and operating expenses. The outputs include revenue, profitability, and cash flow. The purpose of the financial model is to provide a framework for understanding how the business will perform financially under different scenarios.

As an example, I´ll use my SaaS financial model. Below you can see the assumptions page, which includes assumptions and results on one page. When you enter an assumption, you can observe the impact on the same page. This enforces intuitive modeling and makes financial planning much easier!

What´s the purpose of a financial model?

A financial model can help to plan the success of a startup. Firstly, it can help to identify the key financial drivers of the business and forecast how these might change in the future. This information can then be used to create financial projections for the business, which can be used to assess its viability and potential for success. Additionally, a financial model can help to identify any potential risks or issues which could impact the startup’s ability to achieve its financial goals.

What are the benefits of a financial model?

Using a financial model, you can

- set clear goals

- illustrate your growth trajectory

- convince partners, investors, and financiers

- build a detailed forecast for revenue and expenses

- gain a deeper understanding of your business

- discover precious opportunities

- optimize your business model

- and test different distribution channels

Setting clear goals

First, setting clear goals can help ensure the fledgling company remains focused and on track. Additionally, having specific aims can make it easier to measure progress and gauge whether or not the business is successful. Moreover, setting goals can also motivate employees and help to create a sense of purpose within the organization. Finally, from an investor’s perspective, having defined objectives can instill confidence and encourage continued support.

With a financial model, setting goals becomes easy. Enter your assumptions to build a complete financial plan with all the details for revenue, profit, marketing, conversion, etc. Then optimize the model by testing different inputs. Review and modify every detail of your model until it becomes a resilient foundation. Reaching this level, your financial model delivers tons of specific goals that you can measure and pursue. I.e., starting with marketing, the model below tells us exactly the requirements for a successful ads campaign. We need a monthly ads budget of $2,000, a CPC of $1, and conversion of click to user of 25% to reach the planned outcome.

Illustrating the growth trajectory

Perhaps most importantly, a financial model can help give potential investors a clear idea of the company’s potential. Additionally, it can help existing shareholders assess the company’s progress and decide whether to sell or hold onto their shares. Furthermore, illustrating the growth trajectory of a startup can also be helpful for management in setting goals and measuring progress.

In my SaaS financial model (see the picture above), you can consider five main growth drivers:

- Growth rate of organic web traffic in % per month

- Increase of ads budget in % per month

- Increase of influencer shoutouts in % per month

- Number of sales reps for each month

- User churn rate per month in %

Convince investors and financiers

Raising capital allows the company to have the necessary funds to get off the ground and grow. Additionally, it provides credibility and validation from investors, which can help attract new customers and partners. Moreover, it can help with recruitment by signaling potential employees that the company is viable and has long-term potential. Finally, it can give the company a competitive edge by providing extra resources to invest in new products or services.

Investors love to see numbers that make sense. And they, even more, love to have a model they can play with. To convince them, you can screenshot compelling sections from the financial model, i.e. the summary from the assumptions page, and insert it into your pitch deck.

Excerpt from my pitch deck template

Forecast of revenue and expenses

A forecast of revenue and expenses gives the startup team a clear understanding of the company’s financial situation and what needs to be done to achieve profitability. Furthermore, it allows for contingency plans in case actual results differ significantly from the forecast.

When you enter assumptions for marketing and subscriptions into the SaaS financial model, you get a detailed revenue forecast for five years, monthly and yearly. Below you see the yearly income statement of my SaaS financial model.

Figuring out the economics

The economics of a startup is the financial and economic activities associated with starting and running a new business. This includes the cost of goods and services, the price of labor, the cost of capital, and the revenue generated by the business.

There are a few key benefits to understanding the economics of a startup. Firstly, it can help entrepreneurs make more informed decisions about allocating resources. Secondly, it can help investors better assess the risk and potential return of a startup. And lastly, it can provide insights into the overall profitability and viability of a startup.

In other words, understanding the economics of a startup can provide valuable insights into whether or not a particular startup is likely to be successful.

When running a SaaS business, getting the price right is key to success. My SaaS financial model is perfect for testing different price levels; simply enter a different monthly subscription fee to discover the impact on revenue and profit.

By observing the cash balance (monthly and yearly), you get a forecast of your liquidity. If the cash balance turns negative in a certain month, you get an early warning signal that allows you to adapt your plan or raise capital before the problem occurs.

Discovering opportunities

The benefits of discovering precious opportunities of a startup are many and varied. Perhaps the most obvious is the potential for financial gain, as a successful startup can offer a significant return on investment. However, there are other benefits as well. For example, being involved in a startup can provide invaluable experience in entrepreneurship and business management. Additionally, it can be an opportunity to network with other like-minded individuals and make valuable connections. Finally, it can simply be an exciting and enjoyable experience.

My SaaS financial model calculates the User Acquisition Cost [UAC] for each marketing campaign and the User Lifetime Value. When UAC is lower than ULTV, your marketing is profitable, which provides an opportunity to expand efforts and profits.

Onetime sales (In-App Purchases) are an opportunity to provide extra value to your customers. The SaaS financial model lets you plan three different products, like ebooks, downloads, or courses.

Optimizing the business model

A startup’s business model is its plan for generating revenue and profits. Such a model includes the company’s value proposition, market strategy, sales channels, customer relationships, and business model canvas.

There are several benefits to optimizing the business model of a startup. First, it can help the startup to understand its target market better and develop a more effective marketing strategy. Additionally, it can help the startup to identify opportunities and optimize its operations to improve efficiency and profitability. Finally, optimizing the business model of a startup can also help attract investors and partners, which can provide essential resources and support for the company’s growth.

Your first set of inputs probably won´t represent your final business plan. Optimization is key to developing a compelling and realistic financial plan for your business.

Apply three steps for every assumption: 1) Enter an assumption. 2) Observe the impact. 3) Optimize by testing a different assumption. You can do this with every assumption, i.e. subscription fees, sent marketing emails per month, PPC ads budget, churn rate, etc.

Testing different distribution channels

A startup’s distribution channels are the mechanisms through which its product or service is made available to consumers.

The most common type of distribution channel is a direct sales force, which involves the company selling its products or services directly to consumers through its salespeople. Other distribution channels include indirect sales forces (retailers), agents and distributors, and online channels. There are several benefits to testing different distribution channels for a startup. First, testing different channels allows the startup to assess which channels are most effective regarding reach, cost, and conversion rate. Second, by testing different channels, the startup can identify any bottlenecks or pain points in their current distribution strategy.

With my SaaS financial model, you can plan the five most popular marketing strategies: organic web traffic, online ads, Email newsletters, influencer marketing, and sales reps.

Conclusion

Using a financial model as a guide, startups can increase their chances of success. A model provides a framework for making decisions and planning for the future. It is important to remember that no model is perfect, and there is always risk involved in starting a business. However, by carefully considering all potential outcomes, a startup can put itself in a much better position to succeed.

Check out these ready-to-use templates

SaaS financial model

Mobile app financial model

Sources:

[1] Failory – https://www.failory.com/blog/startup-failure-rate

[2] Entrepreneur – https://www.entrepreneur.com/article/238088Fai

Peter is a solopreneur in Salzburg, Austria, a husband, and a family father. He runs a little publishing company, and blogs about starting and running online businesses. In his spare time, he enjoys hiking with friends and reading the Bible, and sometimes he takes a trip in his roaring old black 2001 Jaguar XJ8.