When starting a business, one of the most important things you need is to raise capital. This can be done in several ways, such as through private investors, venture capitalists, or public offerings. However, one of the most common ways to raise capital is through a loan from a financial institution. Before we get into the benefits of a financial model, let’s briefly look at the basics.

- What is a financial model?

- What are the benefits of a financial model?

- Benefit #1 In-Depth Understanding of the Business

- Benefit #2 Valuation of the Business

- Benefit #3 Minimizing Startup Risks

- Benefit #4 More Reliable Forecasts

- Benefit #5 Developing a Profitable Strategy

- Benefit #6 Growing the Business

- Benefit #7 Keeping an Eye on Performance

- Benefit #8 Ensure sufficient Liquidity

- Benefit #9 Develop profitable Marketing Strategies

- Benefit #10 Making Informed Decisions

- Conclusion

- FAQ

- What types of financial models are there?

- What about KPIs?

- Is it difficult to build a financial model?

- What are the hallmarks of a sound financial model?

- Templates for financial models

What is a financial model?

To get a loan from a bank, you will need to provide them with a financial model. A financial model is simply a tool built within a spreadsheet software such as MS Excel to forecast a business’ financial performance into the future. The forecast is typically based on the company’s historical performance and assumptions about the future. It requires preparing an income statement, balance sheet, cash flow statement, and supporting schedules (a 3 statement model).

What are the benefits of a financial model?

Benefit #1 In-Depth Understanding of the Business

A financial model can provide a deep understanding of customers, revenue, expenses, and risks. This information is essential in making sound decisions about where to allocate resources and how to grow the business. A financial model can also help to identify potential areas of improvement and take steps to mitigate risks. By developing a comprehensive financial model, companies can gain a clear and actionable understanding of their operations. This, in turn, can lead to better decision-making, increased profitability, and improved long-term financial health.

Benefit #2 Valuation of the Business

A financial model is a tool that can be used to provide a valuation of a business. The most common method for valuing a business is to discount its future free cash flow back to the present day. This free cash flow can be calculated by considering some factors, including the company’s revenue, expenses, capital expenditures, and tax rate. The fair value of a business is then determined by discounting this free cash flow back to the present day at an appropriate rate of return. For example, if a company is expected to generate $100 in free cash flow next year and has a discount rate of 10%, then its fair value would be $90 today. Investors can use financial models to assess whether or not a company is worth investing in.

Benefit #3 Minimizing Startup Risks

A financial model helps to assess the potential risks and rewards of a new venture, and it can be used to set prices, track competition, and make other strategic decisions. In short, a well-constructed financial model can help to minimize the risk of a new business. Of course, no model is perfect, and there is always some inherent risk in any new venture. However, a financial model can provide a valuable framework for due diligence and decision-making. By taking the time to build a comprehensive and accurate model, startups can give themselves a better chance of success.

Benefit #4 More Reliable Forecasts

You can develop more reliable forecasts and budgets. A well-crafted financial model will take into account a business’s strategic goals and activities and use this information to generate realistic predictions about future income and expenses. Additionally, a financial model can be used to conduct sensitivity analysis, which can help business owners identify potential risks and opportunities. This can prevent costly mistakes.

Benefit #5 Developing a Profitable Strategy

Any business owner knows that prices are essential. They directly affect how much revenue a business can generate and can also have a significant impact on costs. This is why prices are a critical factor in any financial model. By understanding prices, businesses can develop strategies to improve their bottom line. For example, if a company knows that its prices are too high, it can work to lower them to increase sales. Alternatively, if prices are too low, a company may be able to raise them to improve margins. In addition to prices, another critical factor in financial modeling is COGS. This stands for “cost of goods sold” and includes all of the direct costs associated with producing and selling a product or service. Businesses can develop strategies to reduce these costs and improve profitability by understanding COGS.

Benefit #6 Growing the Business

Any business is looking to grow. By carefully projecting marketing costs, customer acquisition costs, and lifetime value, a business can create a roadmap to profitability. Moreover, a well-crafted financial model can help to raise capital by providing potential investors with a clear picture of the company’s potential. In short, a financial model is an essential tool for any business that is serious about growth. Providing insights into marketing, customer acquisition, and lifetime value can help businesses make smart decisions and achieve their goals.

Benefit #7 Keeping an Eye on Performance

Businesses can use a financial model to track and predict their financial performance. The model can include all of the company’s revenue and expense and its assets and liabilities. This information is then used to calculate important metrics such as profit, return on investment, and cash flow. Financial models are essential for keeping an eye on the performance of a business. They help managers understand where the company is making money and where it is losing money. They also provide a way to compare the performance of different departments or products of a business. As a result, financial models are an essential tool for any business that wants to stay afloat.

Benefit #8 Ensure sufficient Liquidity

A liquidity crisis can spell disaster for any business. By monitoring the company’s cash flow, a financial model can help to ensure that there is always enough cash on hand to pay its bills. Additionally, a financial model can help to forecast future cash needs so that businesses can take steps to address any potential problems. In short, a financial model is a critical tool for ensuring the Liquidity of a company.

Benefit #9 Develop profitable Marketing Strategies

One of the most important aspects of any business is marketing. By understanding how much it costs to acquire a customer and how much that customer is worth over the lifetime of the relationship, businesses can develop profitable marketing strategies. Moreover, by tracking marketing performance, businesses can better understand which marketing campaigns are working and which ones need to be tweaked or scrapped altogether. In short, financial modeling is essential for developing profitable marketing strategies.

Benefit #10 Making Informed Decisions

Ultimately, the goal of any business is to make money. By using a financial model, companies can make informed decisions that will help them achieve this goal. The model can explain how different changes (such as price changes or marketing campaigns) will impact revenue and expenses. This information can then be used to make sound decisions that will benefit the business in the long run.

Conclusion

Financial models are an essential tool for any business. They provide a snapshot of the company’s financial performance and help to identify areas where improvement is needed. You can ensure that your startup remains on track and heads in the right direction by tracking your KPIs. A well-structured financial model is the foundation of a successful business plan.

If you want to start with your financial excel model right away without the pain of building it, check out my templates!

FAQ

What types of financial models are there?

Based on a financial model with the three statements for income, cash flow, and balance, more advanced types of models can be built, such as discounted cash flow analysis (DCF model), leveraged-buyout (LBO), mergers, and acquisitions (M&A), and sensitivity analysis. These more advanced models can be highly beneficial to existing businesses when trying to raise additional capital to fund growth.

For example, a business is looking to do a private placement with some angel investors. To get the angel investors interested in investing, the company might create a DCF model that shows how the investment will provide a positive return on investment (ROI) for the angel investors. This type of information can be highly persuasive to potential investors.

Another example would be if a business were looking to do a venture capital round. To get the venture capitalists interested in investing, the company might create a model that shows how the investment will help the company grow and scale. This type of information can be very beneficial for venture capitalists as they are looking to make a high-return investment.

Overall, financial models can be a beneficial tool for businesses when trying to raise capital. They allow companies to better explain their financial situation and forecast their future performance. Such information can be very persuasive to potential investors and help businesses secure their capital to grow and succeed.

What about KPIs?

As a startup, one of the most important things you can do is to keep track of your KPIs. Your KPIs are a measure of your company’s performance, and they can help you to identify areas where you need to improve. For example, your customer acquisition costs (CAC) and lifetime value (LTV) are two important financial KPIs. If your CAC is higher than your LTV, then you’re losing money on each customer. Likewise, if your churn rate is high, then you’re losing customers at a rapid pace. By tracking your KPIs, you can quickly identify these problems and take steps to correct them. In short, your KPIs are essential for ensuring that your startup remains on track and investors love them.

Is it difficult to build a financial model?

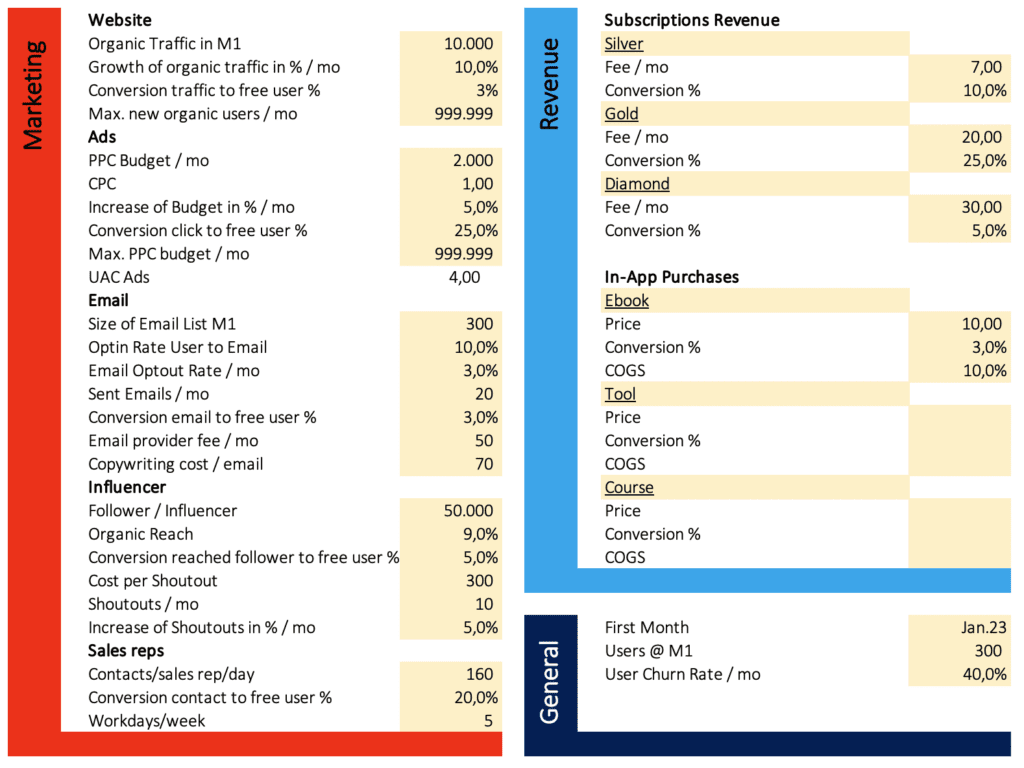

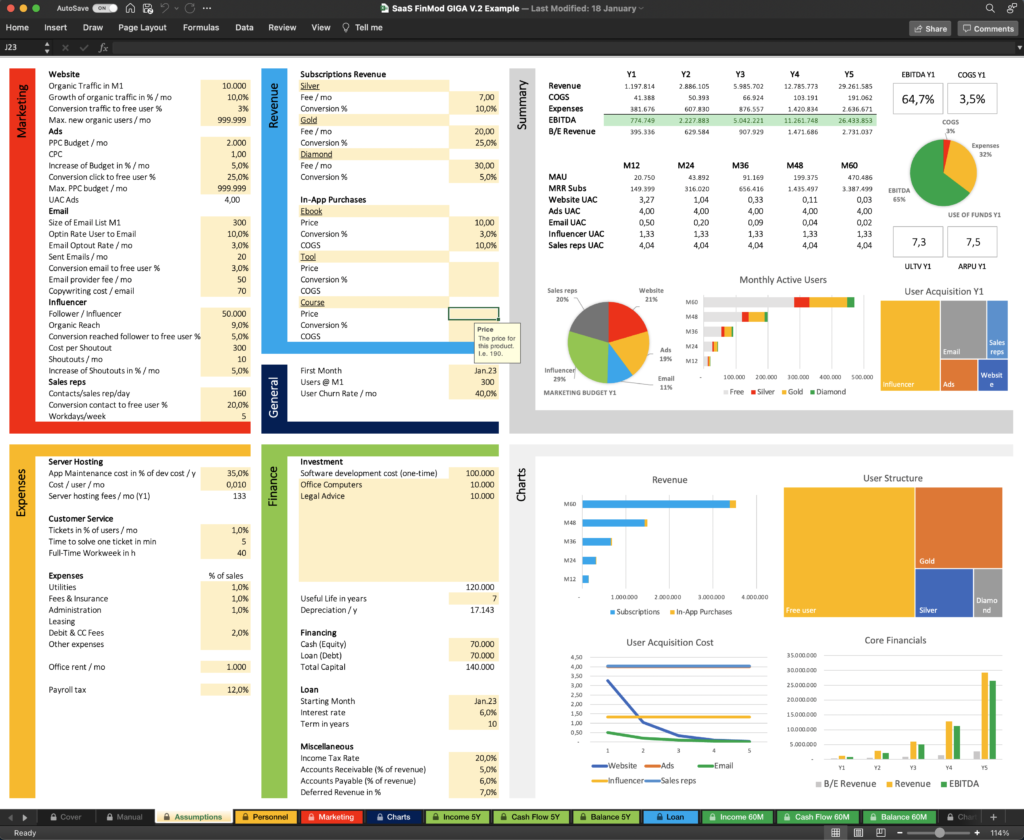

While building a financial model may seem daunting at first, it can be relatively straightforward if you break it down into its component parts. The first step is to gather data on income. This includes marketing, revenue, and expenses. To also build a cash flow statement and a balance statement, you further need assumptions for the necessary investment, depreciation, loan amount, and interest rate. With this information in hand, you can build a model that will help you understand the financial plan of your business and forecast the future. While creating a financial model may take some time and effort, it can be a valuable tool for convincing financiers and investors.

What are the hallmarks of a sound financial model?

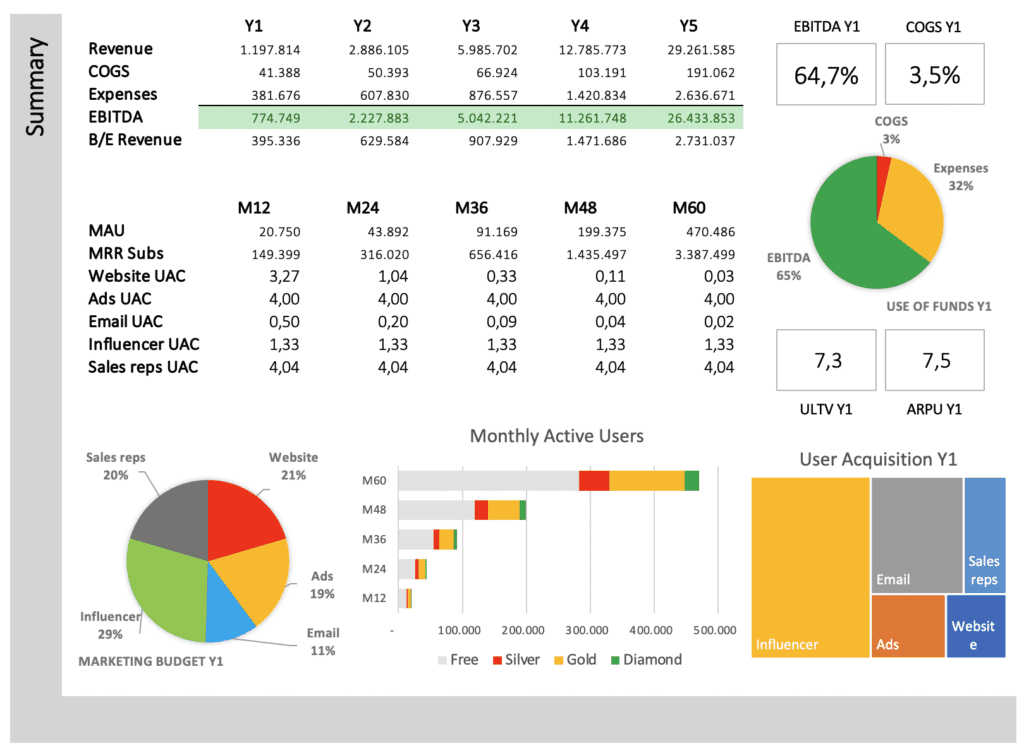

A well-structured financial model is the foundation of a good business plan. It should be simple and easy to understand, with clear charts and diagrams that illustrate the company’s financial picture. The model should be flexible, so that it can be easily updated as new information arises. And finally, it should be user-friendly, so that anyone can quickly navigate and interpret the data. A good financial model is an essential tool for any business, large or small. By clearly outlining the company’s income and expenses, it provides a roadmap for success and helps to ensure that all stakeholders are on the same page. When done well, a financial model can provide invaluable insights into a company’s operations and help to steer it toward a bright future.

Templates for financial models

If you’re looking to create a financial model for your business, I recommend checking out my templates. They’re easy to use and can help you get started quickly. Their unique benefit is the one-screen-assumptions page, which enforces intuitive modeling. So what are you waiting for? Click the link below to check them out!

Peter is a solopreneur in Salzburg, Austria, a husband, and a family father. He runs a little publishing company, and blogs about starting and running online businesses. In his spare time, he enjoys hiking with friends and reading the Bible, and sometimes he takes a trip in his roaring old black 2001 Jaguar XJ8.