If you’re looking to create a financial excel model for your mobile app, there are a few key things you need to keep in mind. First, you’ll need to come up with realistic projections for your app’s revenue and expenses. Second, you’ll need to make sure your model is accurate and easy to use. In this blog post, we’ll discuss some tips and strategies for creating a financial excel model for your mobile app. We’ll also provide a few examples that you can use as a reference.

- What is a financial excel model and why do you need one for your mobile app?

- How to create a financial excel model for your mobile app

- The Elements of a financial excel model for a mobile app

- Tips and strategies for creating a financial excel model

- The assumptions for building a financial model

- Final thoughts

What is a financial excel model and why do you need one for your mobile app?

If you’re planning on launching a mobile app, it’s important to have a financial excel model in place. This will help you track your income and expenses, and forecast your financial performance. A financial model will also enable you to identify potential financial risks and opportunities. Without a financial model, it would be difficult to assess the financial viability of your mobile app. So if you’re serious about launching a successful app, make sure you create a financial model before you get started.

How to create a financial excel model for your mobile app

Creating a financial excel model for your mobile app can seem like a daunting task, but with a few simple steps, you can create a professional and accurate model. First, you’ll need to gather data on your app’s revenue and expenses. If you don´t have a running business yet, you need to estimate your assumptions. Research industry benchmarks and make your best educated guess. Next, you’ll need to input this data into an excel spreadsheet. Be sure to include formulas so that you can easily update the financial model as new data becomes available. Finally, you’ll need to format the financial model so that it is easy to read and understand. With these steps, you can create a financial excel model for your mobile app that will help you make sound business decisions.

The Elements of a financial excel model for a mobile app

A financial model for a mobile app must take into account a number of key elements in order to be effective. Firstly, it must take into account the revenue streams of the app, including advertising, in-app purchases, and subscriptions. Secondly, it must track the costs associated with developing and maintaining the app, including hosting costs, employee salaries, and marketing expenses. Finally, it must forecast the future financial performance of the app, taking into account factors such as user growth and churn rates. By taking all of these elements into account, a financial model can give insights into the viability of a mobile app business and help to make important financial decisions.

Tips and strategies for creating a financial excel model

A financial excel model is a tool that can be used to help you manage your finances and make better financial decisions. There are many different ways to create a financial excel model, but there are some basic tips and strategies that can help you get started.

One of the first things you need to do is decide what type of financial information you want to include in your model. This will help you determine the structure of your model and what types of formulas you will need to use. Once you have this information, you can start creating your financial excel model.

Another important tip is to make sure that your financial excel model is easy to use and read. This means using clear and concise formulas and labels. You also want to make sure that the data is easy to update as new information becomes available.

Finally, it’s important to format your financial excel model in a way that makes it easy to understand. This can be done by using charts and graphs to display your data. By following these tips and strategies, you can create a financial excel model for your mobile app that will help you make sound business decisions.

The assumptions for building a financial model

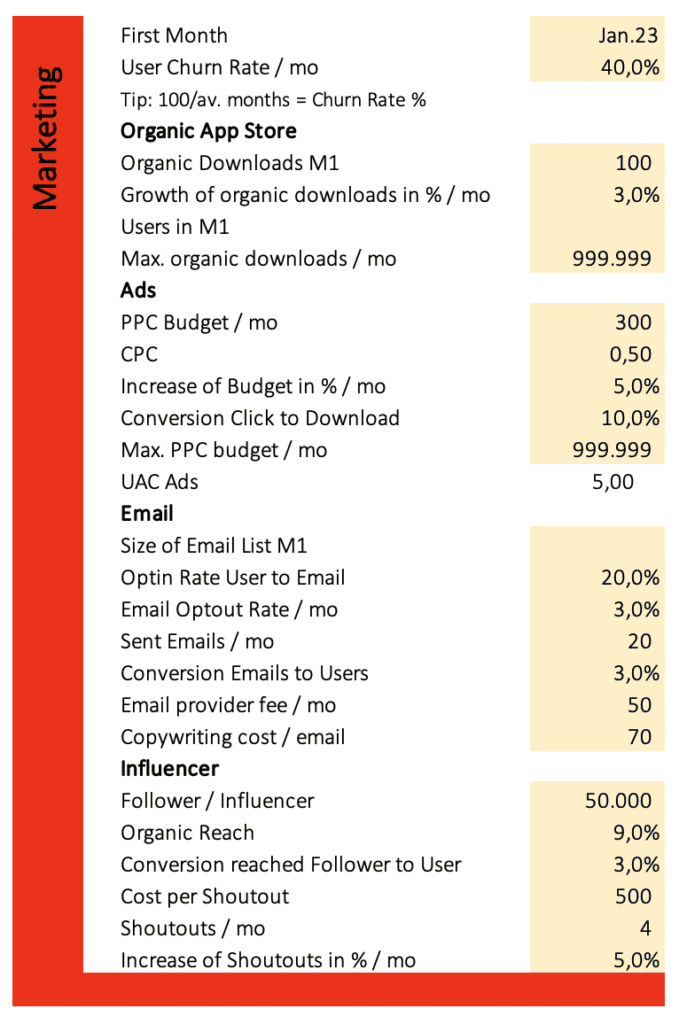

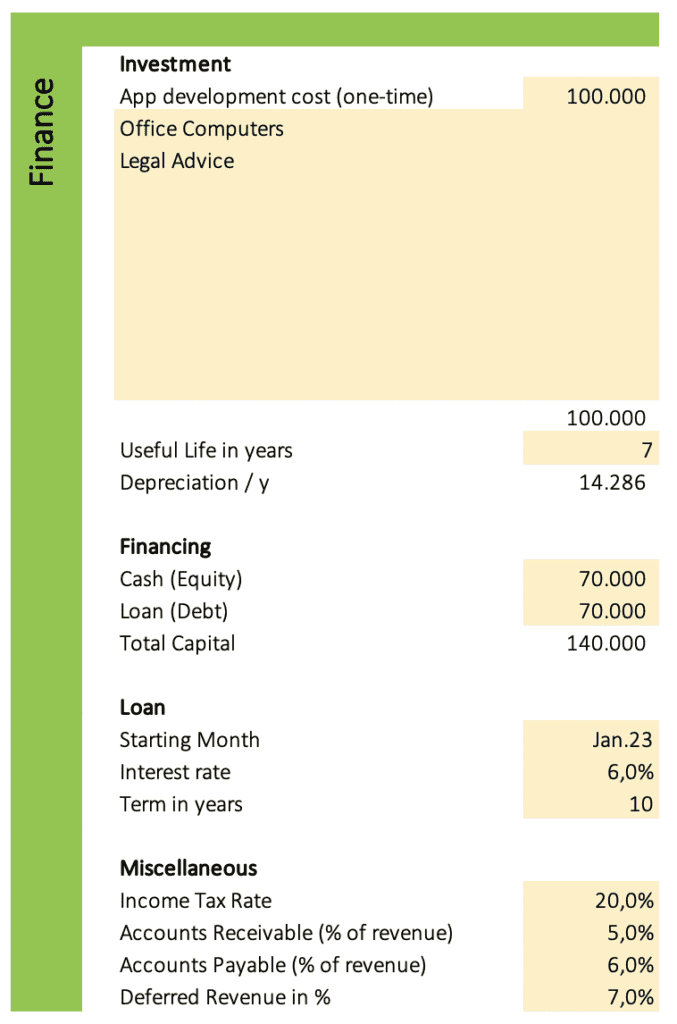

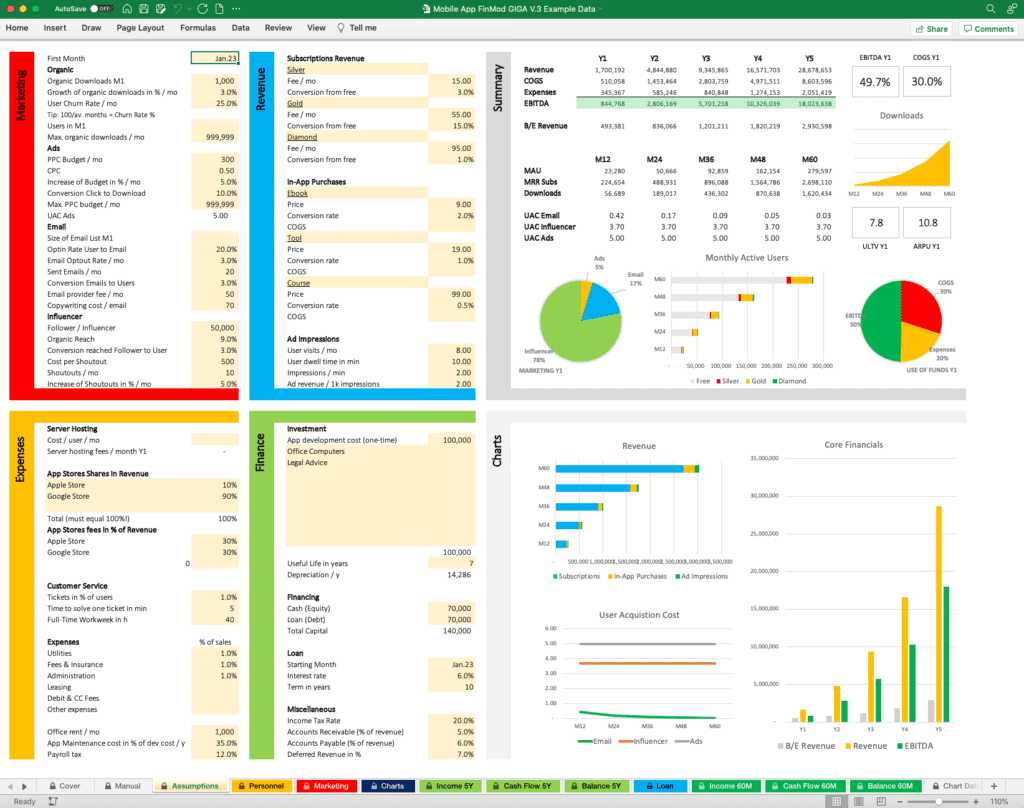

To get a complete financial model, you need assumptions for marketing, revenue, expenses, and finance.

4 powerful marketing strategies to start a mobile app business

The marketing assumptions for a financial model should include at least organic website traffic, email marketing, online ads, and social media.

Organic website traffic will provide the best return on investment (ROI), as it is free and targets those who are interested in the product. Any website owner knows that generating traffic is essential to success. After all, without visitors, there would be no one to view your content or make purchases. While there are many ways to generate traffic, organic traffic is often seen as the most desirable type. Unlike paid traffic, which can be costly and difficult to sustain, organic traffic is free and relatively easy to generate. One of the best ways to generate organic traffic is through content marketing. By creating high-quality blog content and promoting it through social media and other channels, you can attract visitors to your site and convince them to keep coming back. In addition to being free, organic traffic is also more valuable than other types of traffic. This is because visitors who find your site through a search engine are more likely to be interested in what you have to offer than those who are targeted with paid ads.

Online ads can be a great way to reach new customers and promote your products or services. However, there are also some potential downsides to online advertising. One concern is that online ads can be intrusive and interrupt the user experience. Another issue is that online ads can be placed on sites that are not related to your business, which can create a confusing or negative association with your brand. Finally, online ads can be expensive, and there is no guarantee that they will be effective. Ultimately, whether or not online ads are right for your business depends on your specific goals and budget. If you do decide to use online advertising, be sure to test different strategies and monitor your results carefully to ensure that you are getting the most bang for your buck.

Social media is a powerful tool that can reach a large audience for relatively little cost. Influencer marketing has become an increasingly popular marketing strategy in recent years. By partnering with influencers – typically individuals with large social media followings – businesses can reach a larger audience and promote their products or services in a more cost-effective way. influencer marketing can also be an effective way to build brand awareness and create a positive association with a company or product. When done well, influencer marketing can be a powerful tool for businesses of all sizes.

Email marketing can be a powerful tool for promoting your business, but only if it is used correctly. One of the biggest mistakes that businesses make with email marketing is assuming that everyone on their email list is interested in hearing from them. This simply isn’t the case. In order to be successful, email marketing must be targeted and relevant. Every email should have a specific purpose, and it should only be sent to people who are likely to be interested in what it has to say. With this in mind, businesses should take care to segment their email lists and only send messages to those who are likely to be interested. By doing so, they can ensure that their email marketing is both effective and well-received.

By focusing on organic traffic, online ads, email marketing, and social media, your business will be able to reach its target market and generate leads.

3 ways to generate revenue with a mobile app

The business model describes, how you generate revenue with your mobile app. There are a few different ways to generate revenue with a mobile app. One option is to offer subscriptions. This could be a monthly or annual subscription, and it would give users access to premium content or features that they wouldn’t be able to get elsewhere. Another option is to offer in-app purchases. This could include things like digital goods or services, and it would give users the ability to pay for things within the app. Finally, you could generate revenue through ad impressions. This would involve displaying ads in the app, and you would get paid based on how many people see the ads. All of these are viable options for generating revenue with a mobile app, and it’s up to you to decide which one makes the most sense for your business.

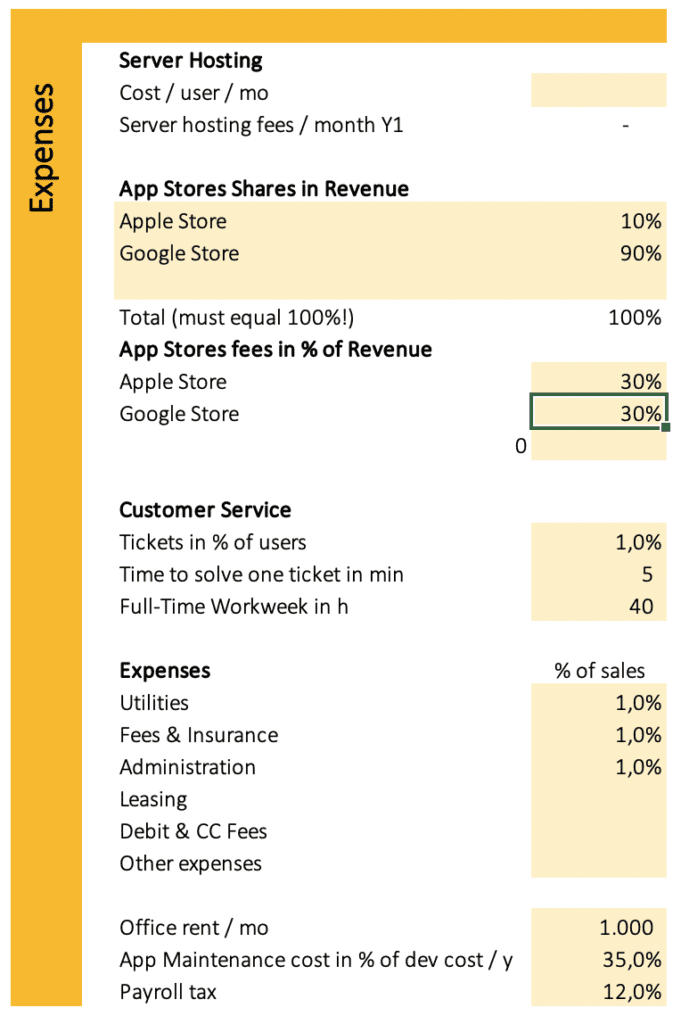

The expenses you need to know when starting a mobile app business

For those looking to get into the mobile app business, there are a few key expenses that should be taken into account. First, there is the cost of server hosting. This is necessary in order to keep the app available to users at all times. Second, there are the fees associated with listing the app on popular app stores, mostly Google Play Store and Apple Store. These can vary depending on the store, but they are typically around 30% of sales. Finally, there are general business expenses, such as personnel, payroll tax, utilities, fees and insurance, administration, leasing, debit and credit card fees, office rent, and software maintenance. These costs can vary depending on the size and scope of the app business, but they should be considered when budgeting for a new mobile app business.

3 ways to fund your mobile app business

If you’re looking to start an app business, you’ll need to develop your software, and you’ll need one or more computers and such stuff. Create a list of the necessary investments and estimate the cost for each position.

One of the most important aspects of starting a new business is obtaining the necessary funding. For many entrepreneurs, this can be a challenge. But with a little creativity and perseverance, it is possible to find the money you need to get your business off the ground.

One option is to seek equity funding from investors. This can be a great option if you have a solid business plan and are confident in your ability to execute it. However, it is important to remember that equity investors will want a stake in your company in exchange for their money.

Another option is to take out a bank loan. This can be a good choice if you have strong personal credit and are confident in your ability to repay the loan. However, it is important to be aware that bank loans can be difficult to obtain and come with high interest rates.

A third option is to use crowdfunding. This is a great way to raise money from a large number of people, and it doesn’t require you to give up any ownership in your company. However, it can be difficult to generate enough interest in your project to meet your funding goal.

No matter which option you choose, it is important to remember that starting a new business is a risky endeavor. There is no guarantee that your app will be successful, and you could end up losing money on the venture. But with a well-conceived business plan and a little bit of luck, you can make your mobile app dreams a reality.

Final thoughts

Building a financial model for your mobile app is an important step in the process of starting a business. However, it can be time-consuming and tedious to do it yourself. If you want to save time, you can check out my financial model template, which I created specifically for mobile apps. With this template, you can quickly and easily generate a detailed financial plan for your business.

If you like this content, subscribe to my free newsletter to stay in touch!

Peter is a solopreneur in Salzburg, Austria, a husband, and a family father. He runs a little publishing company, and blogs about starting and running online businesses. In his spare time, he enjoys hiking with friends and reading the Bible, and sometimes he takes a trip in his roaring old black 2001 Jaguar XJ8.