In today’s business world, it’s not uncommon to hear about startups raising millions of dollars in venture capital funding. However, not every business needs VC money to get off the ground. There are other paths to starting a business without VC funding, and bootstrapping is one of the most popular methods.

What is bootstrapping?

Bootstrapping is the process of self-funding a startup. This means that instead of going to investors or banks for money, the founders use their savings, or money from friends and family, to finance the business. By starting the business, the founders will also have to convince customers to buy their services or products. So, bootstrapping taps into the resources of the founders and the customers.

Another aspect is that VC funding builds a tight relationship between founders and investors; while bootstrapping enforces the relationship between founders and customers. And in the end, it’s always the customers who keep a business alive.

The benefits of bootstrapping

Stronger focus on the customer

The bootstrapping approach leads to a stronger focus on the customer because it encourages entrepreneurs to start with a minimum viable product and then use feedback from early adopters to improve the product. This focus on customer feedback allows startups to quickly pivot and iterate based on customer needs, which leads to a better product in the end.

More control

Bootstrapping is a common startup strategy where founders use their resources to finance their businesses. This leads to more control over the company because the founders are not beholden to outside investors. They can make decisions without worrying about whether or not they will please investors. Additionally, bootstrapped companies tend to be lean and agile because they don’t have the same access to capital as their venture-funded counterparts.

Better use of funds

Bootstrapping leads to more creative and effective use of capital because entrepreneurs are forced to be resourceful and find creative ways to finance their venture. This often leads to a more sustainable and successful business.

Stronger foundation

You create a stronger foundation by not relying on outside funding sources as your degree of independency increases.

Lower risk

The main reason bootstrapping has lower risks than venture capital is that the entrepreneur is not beholden to anyone else’s whims or goals. You are more likely to stick with your initial idea. With venture capital, the entrepreneur has to answer to an external investor, which can often lead to compromising the original vision for the business to appease the investor. This can increase the risk of sacrificing long-term goals for short-term profits.

The challenges of bootstrapping

The benefits are great, but self-funding isn´t for anyone and any business. There are also challenges when bootstrapping a startup.

Lack of capital

Starting with little to no money can be a hard thing.

Limited resources

Having little money means also having to be resourceful with what you have.

Personal sacrifice

You will have to give up a decent part of your personal life for the business.

Mental and emotional stress

Running on a shoestring budget can cause constantly worrying about the business.

Time commitment

You will have to invest long hours with little to no breaks.

Yes, bootstrapping can be challenging. However, a well-thought-out business plan helps to overcome these roadblocks.

How to bootstrap a startup

Here are three steps to take when bootstrapping a startup:

Define your business model

A business model is a company’s plan for generating revenue and profits, and it has to answer one question: How will you make money? Your business model describes your products or services, your target market, and your strategy for selling your products or services. There are a variety of business models that startups can use, such as subscription-based models, advertising-based models, or transaction-based models.

Prepare a financial plan

A financial plan will help you to understand the economics of your business, set realistic goals, and stay on track. Your financial plan should include a detailed revenue forecast, explain your growth drivers and costs, and provide at least an income statement. Cash flow and balance statements would be precious because they help to estimate your capital needs and liquidity.

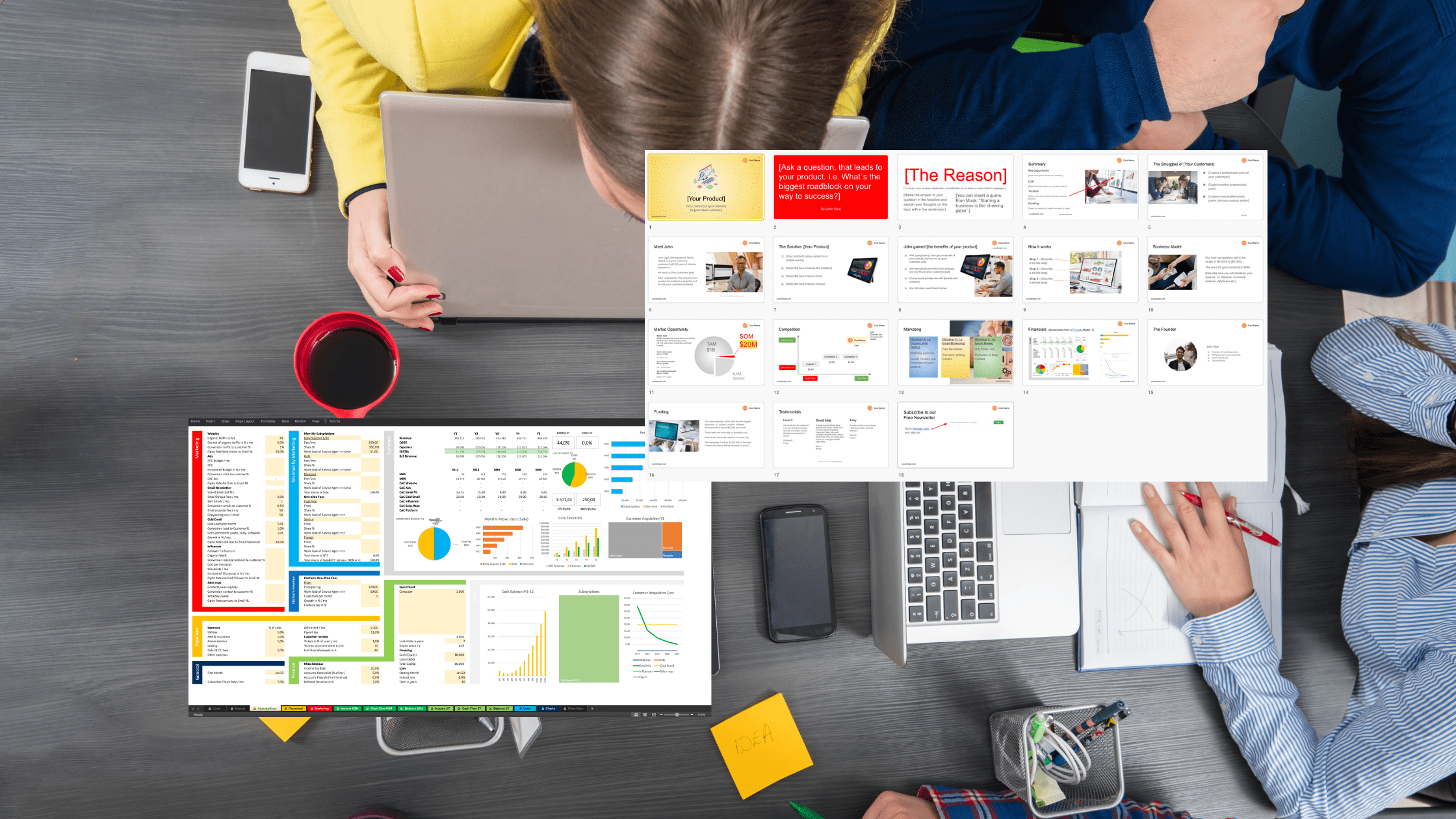

Write a pitch deck

A pitch deck for bootstrappers? Yes, even the solopreneur startup needs a pitch deck. On a bad day when you feel overwhelmed, your pitch deck will be gold. You can grasp it, remember your plan, recharge your motivation and overcome obstacles. Your pitch deck should include a compelling summary of your business plan, namely the customer problem, your solution, your business model, the market opportunity, the competition, your growth strategy, the team, and your financial plan. A well-crafted pitch deck can be a powerful tool for keeping yourself motivated and on track.

Conclusion

A financial plan and pitch deck are essential for bootstrapping a startup. They help to overcome roadblocks and secure funding. Without a solid plan, it will be difficult to launch a successful startup.

Check out my products and services for financial models and pitch decks!

Peter is a solopreneur in Salzburg, Austria, a husband, and a family father. He runs a little publishing company, and blogs about starting and running online businesses. In his spare time, he enjoys hiking with friends and reading the Bible, and sometimes he takes a trip in his roaring old black 2001 Jaguar XJ8.