When it comes to mobile app financial models, there are a few key performance indicators (KPIs) that you need to track. In this blog post, we will discuss the 5 most important KPIs and why they are important for your financial model. Keep in mind that these KPIs will vary depending on your business and industry. With that said, let’s get started!

- What are KPIs?

- Why should you use KPIs?

- The five KPIs for mobile apps you should know and use

- A ready-to-use template, that saves you time and money

- Conclusion

- FAQ

- How can you improve MAU?

- What´s the average MAU for a new mobile app?

- How can I get more users for my mobile app?

- How can you improve churn?

- What´s the average churn rate for mobile apps?

- Can I track mobile app KPIs without a financial model?

- How can I increase MRR?

- How can I reduce CAC?

- How can I increase LTV?

- Can mobile app KPIs vary by country?

- What are some other mobile app KPIs?

- How can you avoid the pain of building a financial model?

What are KPIs?

KPIs are important metrics that you track to measure the success of your mobile app. They can be used to track a number of different things; i.e. users, revenue, or costs.

Why should you use KPIs?

KPIs are important for a financial model because they allow you to track the performance of your mobile app. This information can help you make better business decisions and improve your mobile app.

The five KPIs for mobile apps you should know and use

Now that we know why KPIs are important, let’s take a look at the five KPIs you should track.

#1 MAU

The first KPI is monthly active users (MAU). This metric tells you how many users are using your mobile app on a monthly basis. It’s important to track MAU because it can give you a good indication of how healthy your app is and whether or not it is growing.

#2 Churn

The second KPI is the churn of users. This metric tells you how many users are leaving your mobile app each month. It’s important to track churn because it can help you identify problems with your app and correct them.

#3 MRR

The third KPI is monthly recurring revenue (MRR). This metric tells you how much revenue your mobile app is generating each month. It’s important to track MRR because it can give you a good indication of the health of your business.

#4 CAC

The fourth KPI is customer acquisition cost (CAC). This metric tells you how much money you are spending to acquire new customers. It’s important to track CAC because it can help you identify whether or not your marketing efforts are effective.

#5 LTV or ULTV

The fifth and final KPI is the lifetime value of a customer (LTV) or also called the user lifetime value (ULTV). This metric tells you how much money a customer is worth to your business over the lifetime of their relationship with you. It’s important to track LTV because it can help you make decisions about how much money to spend on acquiring new customers.

A ready-to-use template, that saves you time and money

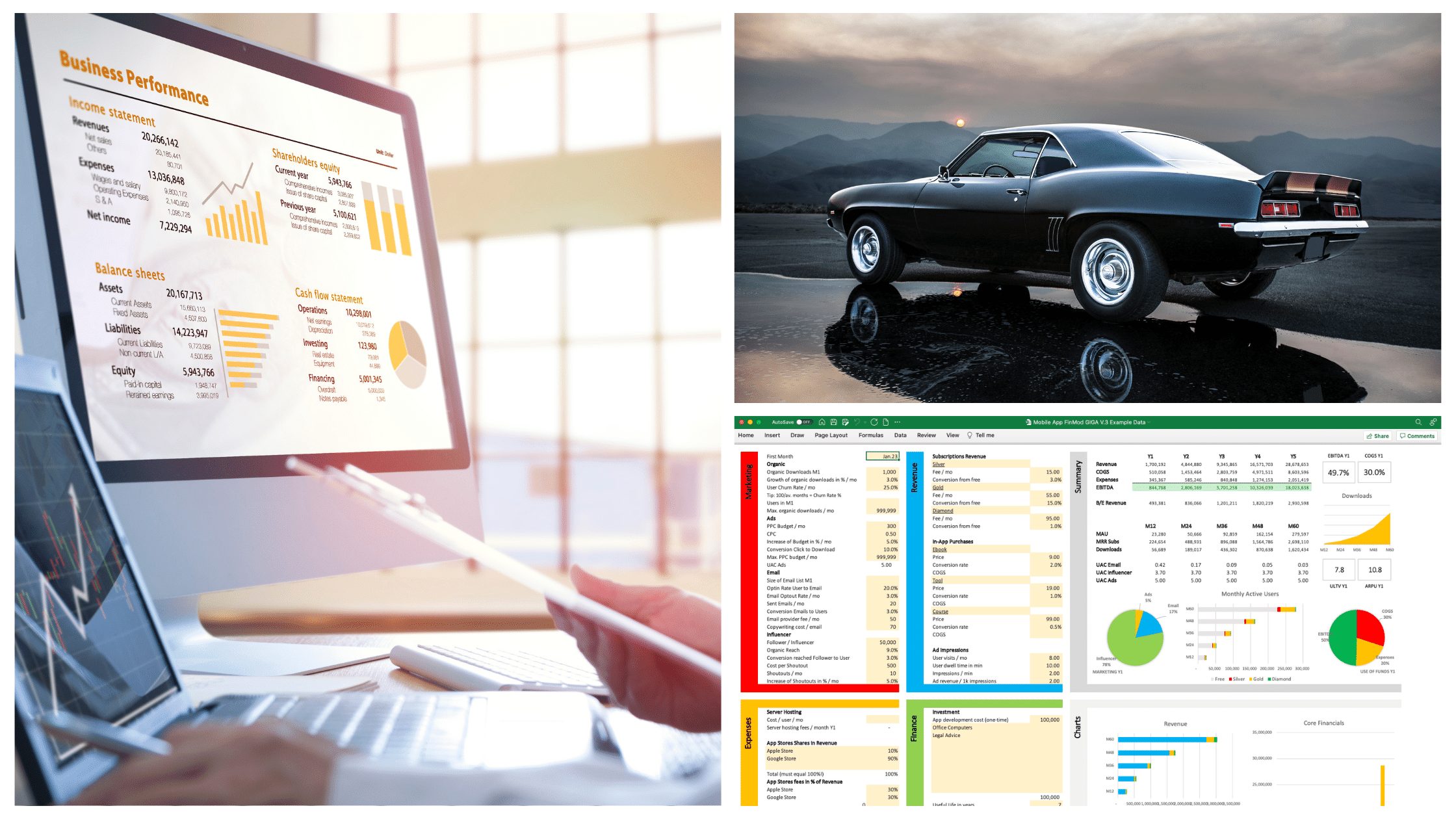

By the way, my Financial Model for a Mobile App contains all five of these top KPIs. Check it out! It has a comprehensive fee model with 3 subscriptions, 3 in-app purchases, and ad impressions.

Conclusion

These are just the most important of the many KPIs that you can track in a mobile app financial model. Keep in mind that the KPIs you choose will depend on your business and industry. By tracking these KPIs, you will be able to make better decisions about the future of your mobile app.

If you’re looking for more information about mobile app financial models, be sure to check out our other blog posts! Thanks for reading!

FAQ

How can you improve MAU?

There are a number of ways to improve MAU. One way is to focus on attracting new users. You can also try to retain your current users by providing a great experience and offering valuable content.

What´s the average MAU for a new mobile app?

There is no one-size-fits-all answer to this question. The average MAU for a new mobile app will vary depending on the business and industry.

How can I get more users for my mobile app?

There are a number of ways to get more users for your mobile app. You can focus on marketing your app to a wider audience through online ads, influencers, content creation, sales reps, and social media, or you can try to generate word-of-mouth buzz.

How can you improve churn?

There are a number of ways to improve churn. One way is to focus on attracting new users. You can also try to retain your current users by providing a great experience and offering valuable content.

What´s the average churn rate for mobile apps?

In 2018, the worldwide average churn rate of mobile apps was 57%.

Can I track mobile app KPIs without a financial model?

It is possible to track mobile app KPIs without a financial model. However, having a financial model will allow you deeper insights into your business and make better business decisions.

How can I increase MRR?

There are a number of ways to increase MRR. One way is to focus on attracting new customers. You can also try to increase the amount of money that each customer spends with you. You can also offer subscription-based pricing plans instead of one-time payments.

How can I reduce CAC?

CAC can be reduced in a variety of ways. One way is to focus on attracting more qualified customers. You can also try to reduce the amount of money that you spend on marketing and sales efforts.

How can I increase LTV?

There are a variety of methods to raise LTV. One option is to concentrate on retaining current consumers. You can also try to increase the frequency or amount of spending by your current customers. Additionally, you can introduce new products and services that will increase the lifetime value of a customer.

Can mobile app KPIs vary by country?

Yes, mobile app KPIs can vary by country. For example, the average churn rate in the United States is typically lower than the global average. Conversely, the average revenue per user in the United States is typically higher than the global average.

What are some other mobile app KPIs?

Some other mobile app KPIs include active users, DAU (daily active users), page views, session length, and bounce rate. These metrics can help you understand how well your mobile app is performing.

How can you avoid the pain of building a financial model?

The easiest and fastest way to a convincing financial plan is my Financial Model for a Mobile App! Its unique benefit is the One-Screen-Assumptions-Page. While you enter your assumptions, you can observe the impact on the same screen. This enforces intuitive modeling and makes financial planning much easier!

Peter is a solopreneur in Salzburg, Austria, a husband, and a family father. He runs a little publishing company, and blogs about starting and running online businesses. In his spare time, he enjoys hiking with friends and reading the Bible, and sometimes he takes a trip in his roaring old black 2001 Jaguar XJ8.