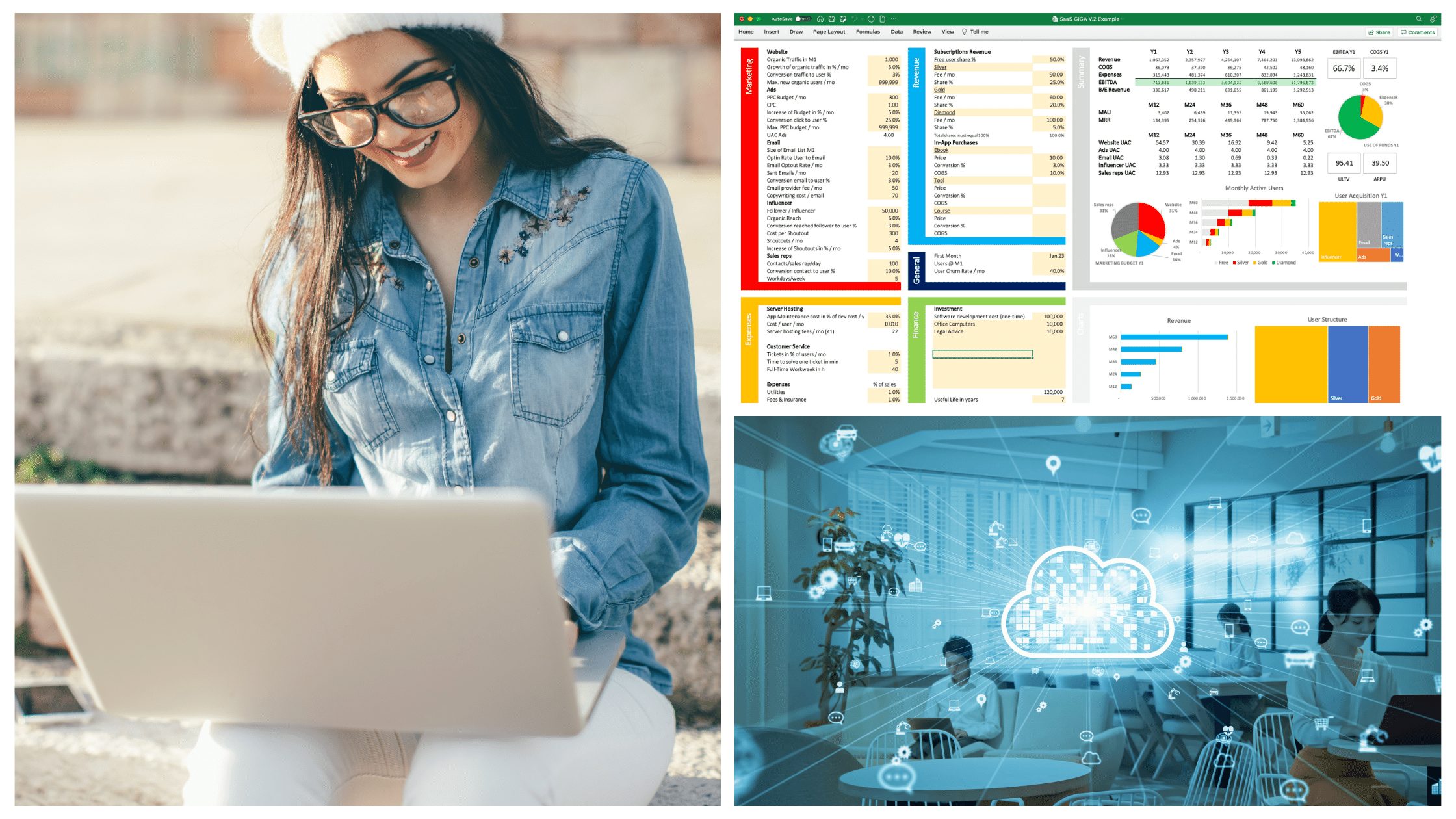

Most startups are founded on an idea or a product that the founders believe in. The passion and excitement of starting a business can sometimes overshadow the need to focus on the financials of the business. It’s important for startups to be aware of financial models and their importance in order to make sure the business is sustainable.

- What is a financial model and why is it important?

- What is a SaaS startup?

- What are the main tasks of a financial model?

- Types of financial models

- How to create a financial model for SaaS Startup

- How to use a financial model

- How to profit from a financial model

- Conclusion

- How many hours do you spend on building financial models?

What is a financial model and why is it important?

A financial model is simply a tool that helps entrepreneurs make informed decisions about their business and it can be used to predict the future performance or behavior of an organization or individual. Financial models are important because they allow individuals and organizations to plan for the future. The accuracy of a financial model can be affected by the data that is used to create it, so it is important to use accurate and up-to-date data when creating a financial model.

What is a SaaS startup?

A SaaS startup is a company that creates and sells software over the internet. It’s a newer model for software companies, which have traditionally sold their software through licenses to be installed on company-owned computers. With SaaS, startup companies can reach a larger audience more quickly and cheaply than ever before.

What are the main tasks of a financial model?

There are some main tasks of financial models for businesses: feasibility, break-even analysis, profit & loss, and cash flow. Each model has its own purpose and should be used depending on the stage of your startup. Feasibility analysis is the first step in the financial model process and it should show, that your business will be profitable. Break-even analysis is used to determine at what point your startup will become profitable. Profit & loss shows how much money your startup is making or losing each month. Cash flow measures how much cash your startup has coming in and going out.

Types of financial models

There are different types of financial models: Startup models, growth models, sales models, and forecasting models. In addition to the model being used, the data that is used in a financial model should be considered as well. Startup models are used to estimate the cost of starting up a business. They also help to calculate how much money a startup needs to make before it will be profitable. Growth models are used to gain an understanding of how your startup will increase over time. Sales models are used to forecast the revenues that you will earn in a given period. Forecasting models are used to predict future revenues and cash flows.

How to create a financial model for SaaS Startup

Financial models are important for startups because they help entrepreneurs forecast future cash flows, identify potential sources of funding, and make rational decisions about where to allocate resources. Financial models can also provide insights into the feasibility of a business model, and help assess the risks associated with different investment options.

Research your market

First, determine whether there’s a market for your product. Your target market should be large enough to sustain your business, but also small enough that you can reach and serve them effectively. Do some online research to see if there’s already a similar product on the market. If so, you’ll need to come up with a way to differentiate your product or offer a lower price point. Next, evaluate your competition. How strong are they? Can you beat them on price? Or do you have a differentiating factor that will make customers choose your product over theirs?

Develop a marketing strategy

Once you have a good understanding of the market, the product, and the competitors, you can start to develop a marketing strategy and determine whether or not your SaaS idea is viable. The first step is to create a profile of your ideal customer. Who are they and what needs do they have that your product can address? Once you have this information, you can start to target your marketing efforts toward these people. The five most important marketing campaigns for SaaS startups are blogging, social media, email, online ads, and sales reps.

Design your business model

Your business model describes how you make money. There are several ways for a SaaS company to monetize. The two primary ones are monthly subscriptions and one-time payments. Monthly subscriptions can be used to recoup costs associated with the product (such as bandwidth and storage costs), while one-time payments can be used to incentivize users to use the product. Both methods have their own benefits and drawbacks, so it is important to choose the right one for a given saas product.

Estimate the expenses

Startups have a lot of expenses that go into starting the company- from initial investment to hiring employees. Here are some of the most common startup expenses:

- Marketing and advertising: Startups need to spend money on marketing in order to attract attention from potential customers and investors. This can include things like paying for ads, developing a website, and sponsoring major events.

- Software development: SaaS Startups have to spend money on product development- this includes everything from designing the software to paying for development.

- Legal fees: Startups also have legal expenses that can take up a lot of their budget.

- Office space: Startups need to pay for office space, especially if they are working out of their homes. This can include things like utilities and rent.

- Server hosting: Startups need to pay for hosting their online presence on server space. This can include things like domain registration, web hosting, and bandwidth fees.

- Customer service: In case of issues, you need a system and/or employees, that handle customer support.

Prepare to finance

Startup costs can be challenging for small businesses, especially if they are looking to launch a saas company. You need to provide sufficient cash to pay for the initial investments like product development, computer hardware, and freelancer fees. Fortunately, there are several ways to finance a startup. Options include angels, venture capitalists, traditional loans, or even crowdfunded financing. It is important to choose the right option for your business and understand the risks involved. With the right financing plan in place, a startup can achieve its goals and grow quickly. A lack of cash means, that a business is bankrupt. To avoid this risk, you need a solid financial plan. Finally, determine the amount of capital you need to get your business started. You could use your personal savings or start with a small amount of cash, but it’s important that you do not start without enough capital to run your business for at least six months.

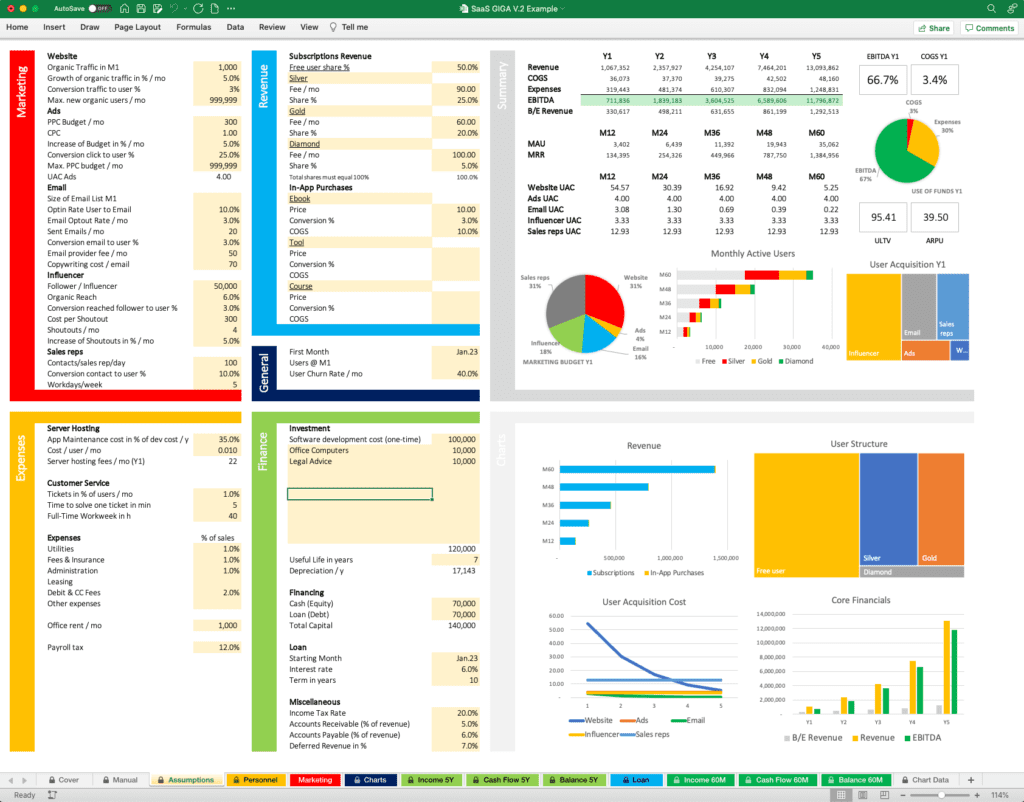

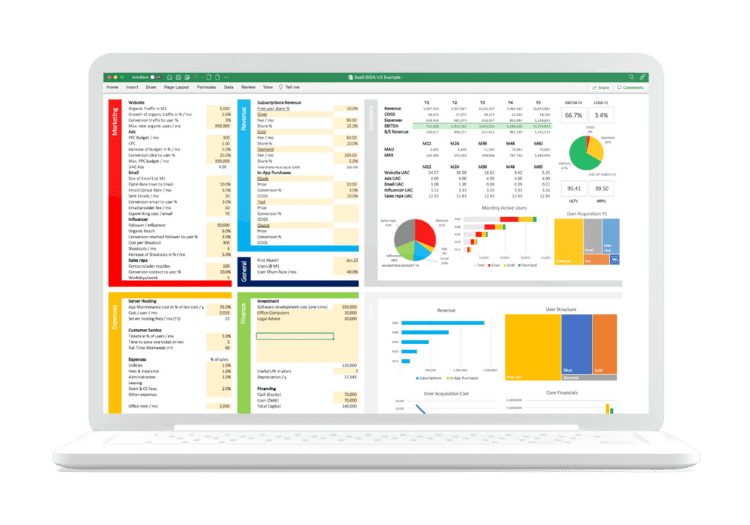

Build a financial model in excel

Building a financial excel model for a saas startup can provide valuable insights into the profitability of the business. By understanding how much money the company is making and how much it is spending, investors and entrepreneurs can make better decisions about whether or not to continue investing in the company. Additionally, a financial excel model can help to optimize sales and marketing efforts. By calculating which products are selling well and which ones need more investment, companies can steer clear of wasting resources on projects that won’t pay off. You can build such a financial model in Microsoft Excel or Google sheets, or you can start with a template, that you adapt to your needs.

How to use a financial model

A well-constructed financial model can provide insights into how different scenarios will play out financially. It can also help identify areas where a company may be experiencing financial stress. In order to get the most out of your financial model, it’s important to understand how to use it effectively. Here are some tips:

- Be careful with your assumptions and stay realistic

- Develop profitable marketing campaigns with CAC (customer acquisition cost) lower than LTV (lifetime value of a customer)

- Test different scenarios, prices, conversion rates, churn rates etc.

- Check the correctness of the model (no formula mistakes)

- Write a list with all necessary investments

- Make sure, that your projected cash balance is always positive (otherwise your business is bankrupt)

- Research industry benchmarks for churn, CPC, conversion, growth, prices etc.

How to profit from a financial model

There are several ways that you can profit from using a financial model. One way is by using the information in the model to help make better investment decisions. If you plan to start a SaaS business, a financial model provides precious insights about your business model. Investors always demand a solid financial plan, so it helps to raise capital too. Another way to profit from a financial model is by using it as a forecasting tool to predict future sales or revenue. Additionally, you can use a financial model to evaluate different business proposals or strategies. Finally, you can use a financial model to assess the risk and potential return on investment of different investments.

Conclusion

In conclusion, financial models are important for saas startups because they allow founders to track their company’s progress and make better decisions about where to allocate their resources. Financial models can also help entrepreneurs secure funding from investors by demonstrating that their business is viable and has a solid plan for growth. Founders should always be prepared to answer questions about their financial model during pitch meetings, and should continually update their model as their company evolves.

How many hours do you spend on building financial models?

Why reinvent the wheel every time? Startups, small businesses, and investors use my templates to build financial models. Increase your chances of raising capital by having a complete financial model ready in no time. Check out my template below!

Peter is a solopreneur in Salzburg, Austria, a husband, and a family father. He runs a little publishing company, and blogs about starting and running online businesses. In his spare time, he enjoys hiking with friends and reading the Bible, and sometimes he takes a trip in his roaring old black 2001 Jaguar XJ8.